Macklem noted inflation remains above the target

Bank of Canada Governor Tiff Macklem is set to hold a press conference following the central bank’s third consecutive 25-basis point rate cut.

Key Takeaways

Inflation may bump up later in 2024; there is a risk that upward forces on inflation could be stronger than expected.

Overall weakness in the Canadian economy is continuing to pull inflation down.

Recent data suggest there is some downside risk to the bank’s July projection of stronger growth in the second half of 2024.

We need to increasingly guard against the risk that the economy is too weak and inflation falls too much.

If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further rate cuts.

There was strong consensus for a 25 basis points cut.

We did discuss different scenarios, including slowing the pace of cuts and also a 50 bps cut.

At this point, a 25 bps cut looked appropriate.

In one scenario, if the economy were weaker than expected, it would be appropriate for a cut larger than 25 bps.

Not seeing big impact on exchange rate from divergence with US Fed on rates.

We need to see Canadian growth above 2%, and the need for more growth factored into our policy decision.

Shelter inflation remains too high.

This section below was published after the Bank of Canada (BoC) interest rate decision at 13:45 GMT

The Bank of Canada on Wednesday reduced its key policy rate by 25 basis points to 4.25%, in line with expectations, while signaling concerns that weaker-than-anticipated growth could lead to a sharper drop in inflation.

Governor Macklem noted in his opening remarks that, with inflation nearing the target, the bank must be increasingly cautious about the risk of an overly weak economy causing inflation to decline excessively.

He emphasized that the central bank is equally concerned about inflation falling below the target as it is about inflation rising above it.

Macklem indicated that the overall weakness in the economy was driving inflation lower, while persistent price pressures in housing and certain services were keeping inflation elevated.

He mentioned that if inflation continued to decrease broadly in line with the BoC’s July forecast, it would be reasonable to anticipate further cuts to the policy rate.

Market reaction

USD/CAD alternates gains with losses around the 1.3540 region, a tad lower than earlier weekly tops in the 1.3565-1.3570 band.

This section below was published as a preview of the Bank of Canada (BoC) interest rate decision at 08:00 GMT

- Bank of Canada (BoC) is seen reducing its policy rate to 4.25%.

- Canadian Dollar started the month on the back foot vs. the US Dollar.

- Headline inflation in Canada dropped further in July.

- Swaps markets see around 36 bps of easing this week.

There is widespread expectation that the Bank of Canada (BoC) will lower its policy rate for the third consecutive meeting on September 4. Mirroring previous decisions by the central bank, this move would most likely be of 25 basis points, taking the benchmark interest rate to 4.25%.

Since the year began, the Canadian Dollar (CAD) has been weakening against the US Dollar (USD), taking USD/CAD to fresh highs near 1.3950 in early August. Since then, however, the Canadian currency has started a period of sharp appreciation, dragging the pair around 5 cents lower by the epilogue of the previous month.

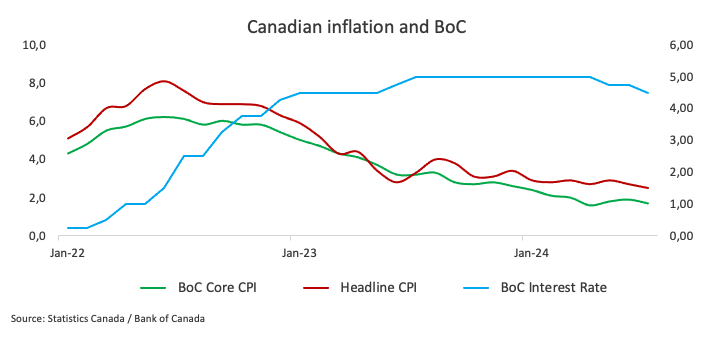

In July, the annual rate of domestic inflation, as measured by the headline Consumer Price Index (CPI), declined further to 2.5% vs. the same month in 2023, and the BoC’s core CPI fell further below the 2.0% target, recording a 1.7% increase over the last twelve months. The expected rate cut by the central bank seems linked to the ongoing decrease in consumer prices and anticipated further easing in the Canadian labour market.

Inflation has stayed under 3% since January, aligning with the central bank’s forecast for the first half of 2024, with key core consumer price metrics also showing a consistent decrease. Additionally, the BoC is likely to continue basing its future rate decisions on economic data. Current swaps markets suggest around 36 basis points of easing in September.

The BoC could maintain its dovish narrative

Despite the anticipated rate cut, the central bank’s overall stance is expected to lean towards the bearish side, particularly against the backdrop of declining inflation (which suggests that the headline CPI could hit the bank’s target anytime soon) and growing slack in the labour market.

Following the rate cut in July, BoC Governor Tiff Macklem argued that the economy is experiencing excess supply, with slack in the labour market contributing to downward pressure on inflation. He explained that their assessment indicates there is already enough excess supply in the economy, and the necessary conditions are increasingly in place to bring inflation back to the 2% target. He also emphasized that rather than needing more excess supply, there is a need for growth and job creation to start picking up to absorb the excess supply and achieve a sustainable return to the inflation target.

Macklem added that the central bank aims to balance the risks on both sides, expressing a determination to bring inflation back to 2% without excessively weakening the economy and causing inflation to fall below the target. He noted that these considerations would be weighed carefully moving forward, and decisions would be made one meeting at a time.

In light of the upcoming interest rate decision by the BoC, Taylor Schleich and Warren Lovely at the National Bank of Canada said:

“The Bank of Canada is set to lower the target for the overnight rate by 25 basis points on Wednesday, the third such move in as many meetings. The only data point that had the potential to derail a cut — the July CPI report — offered encouraging news on the core inflation front, allowing policymakers to ease without controversy.

“Meanwhile, even though the July employment report revealed an unchanged unemployment rate, the labour market outlook remains challenged. Consensus expectations for the unemployment rate (and those implied by the Bank of Canada’s rosy growth projections) are too optimistic, and we still see the jobless rate hitting ~7% by year-end.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, September 4, followed by Governor Macklem’s press conference at 14:30 GMT.

Eliminating any potential surprises, the impact on the Canadian currency is expected to come mainly from the message of the bank rather than the move on the interest rate per se. Taking a conservative approach may result in more support for CAD and a subsequent dip in USD/CAD. If the bank indicates that it intends to decrease interest rates further, the Canadian Dollar may suffer and open the door to further gains in USD/CAD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “USD/CAD has been on a strong downward path since the beginning of August, taking spot to monthly lows near 1.3640 last week. The rebound since then came mainly on the back of the recovery in the US Dollar (USD), prompting the pair to reclaim the 1.3500 barrier and beyond so far.

Pablo adds:

“The immediate target emerges at the 200-day SMA, currently at 1.3589. Once this region is cleared, the pair might revisit the 1.3665-1.3680 band, where the interim 55-day and 100-day SMAs converge. Further up, there are no resistance levels of note until the 2024 peak at 1.3946 recorded on August 6.

“If bears regain the initiative, USD/CAD might revisit its August low of 1.3436 (August 28) prior to the March low of 1.3419 (March 8). A deeper decline beyond the latter exposes a move to the December 2023 bottom of 1.3177 (December 27)”, Pablo concludes.

Economic Indicator

BoC Press Conference

After Bank of Canada (BoC) meetings and the release of the Monetary Policy Report, the BoC Governor and Senior Deputy Governor hold a press conference at which they field questions from the media. The press conference has two parts – first a prepared statement is read out, then the conference is open to questions from the press. Hawkish comments tend to boost the Canadian Dollar (CAD), while a dovish message tends to weaken it.

Last release: Wed Sep 04, 2024 14:30

Frequency: Irregular

Actual: –

Consensus: –

Previous: –

Source: Bank of Canada

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.