UK Employment Data Takes Center Stage Amid Market Caution – Action Forex

The forex markets have remained largely subdued in today’s Asian session, with most major currency pairs moving within a narrow range from yesterday. Investor sentiment stabilized overnight, with major US stock indexes closing higher. However, caution is still the prevailing mood as traders await tomorrow’s US CPI data, which will be pivotal in shaping Fed’s next move. The inflation data will likely be the key determinant in whether Fed opts for a modest 25bps rate cut or a more aggressive 50bps cut at its upcoming meeting.

Earlier today, Australian data had little impact on market sentiment. Consumer confidence in Australia continues to linger at low levels, a trend that has persisted for over two years. Business confidence, meanwhile, has turned negative, signaling rising concerns about the economic outlook. These concerns suggest that RBA’s restrictive policies are cooling the economy as intended, but there is little to suggest that the central bank will bring forward its policy easing cycle, which is supposed to begin next year.

Looking ahead, the spotlight is now on the UK, where employment data is due for release. BoE is expected to take a measured approach to rate cuts, with many analysts believing that next week’s BoE meeting may be too early for another rate reduction. However, this cautious stance depends heavily on no major negative surprises in today’s job data, tomorrow’s GDP figures, and next week’s CPI report.

For the week so far, Loonie is leading the pack as the strongest performer, followed by Aussie and then Dollar. At the other end, Swiss Franc is the weakest, with Yen and Kiwi also under pressure. Euro and Sterling are positioned in the middle.

Technically, GBP/AUD’s pullback from 2.0034 could have completed at 1.9276 already. Multiple support from 55 D EMA is a near term bullish sign too. Further rise is now expected to retest 2.0034 first. Firm break there will resume larger rally. However, break of 1.9536 will suggest that correction from 2.0034 is probably extending with another falling leg through 1.9276.

In Asia, at the time of writing, Nikkei is up 0.08%. Hong Kong HSI is up 0.28%. China Shanghai SSE is up 0.28%. Singapore Strait Times is up 0.38%. Japan 10-year JGB yield is down -0.0001 at 0.895. Overnight, DOW rose 1.20%. S&P 500 rose 1.16%. NASDAQ rose 1.16%. 10-year yield fell -0.013 to 3.697.

Australian Westpac consumer sentiment falls to 84.6, economic concerns deepen

Australia’s Westpac Consumer Sentiment Index saw a marginal decline of -0.5% mom in September, falling from 85.0 to 84.6, reflecting the ongoing pessimism that has gripped Australian consumers for more than two years. According to Westpac, this persistent negativity shows “no real signs of lifting,” with key indicators pointing to growing anxiety about the country’s economic outlook.

Sentiment around economic conditions for the next 12 months dropped from 83.3 to 81.2, while unemployment expectations rose sharply from 133.5 to 138.4, signaling growing concerns about job security. However, the interest rate expectations index saw some relief, falling from 135.5 to 123.8, as consumers became less worried about further rate hikes.

Westpac noted that the focus among consumers appears to be shifting. “While cost-of-living pressures are becoming a little less intense and fears of further interest rate rises have eased, consumers are becoming more concerned about where the economy may be headed and what this could mean for jobs,” the report highlighted.

Australia’s NAB business confidence falls to -4, conditions fairly clearly below average

Australia’s NAB Business Confidence fell from 1 to -4 in August. Business Conditions also declined, dropping from 6 to 3. Trading conditions dipped by 2 points, while profitability slid by 1 point. Forward orders remained unchanged at -4.

NAB Chief Economist Alan Oster commented on the data, noting that “conditions are now fairly clearly below average compared to the history of the survey,” underscoring the broader weakness in the private sector as the economy slows.

The decline in the employment gauge is particularly notable, as it “suggests the period of very strong private sector labor demand seen throughout the post-Covid period may be coming to an end,” Oster added.

China’s exports grow 8.7% yoy in Aug, imports up only 0.5% yoy

China’s exports grew by a robust 8.7% yoy to USD 308.7B in August, surpassing market expectations of 6.5% yoy growth. However, this impressive figure is largely attributed to base effect, as exports contracted by -8.8% yoy during the same period last year.

Exports to key regions such as the US, the EU, and the ASEAN all posted solid gains. Notably, exports to the EU saw the largest increase, growing 13% yoy.

In terms of imports, China’s intake from the US rose by 12% yoy, while imports from the EU showed a decline. Imports from ASEAN grew by 5% yoy. Overall import growth remained weak, increasing by just 0.5% yoy compared to the expected 2.0% yoy.

China’s trade surplus widened significantly, rising from USD 84.65B in July to USD 91.02B, exceeding expectation of USD 83.9B.

Looking ahead

UK employment data is the key focus in European session today. The US calendar is empty.

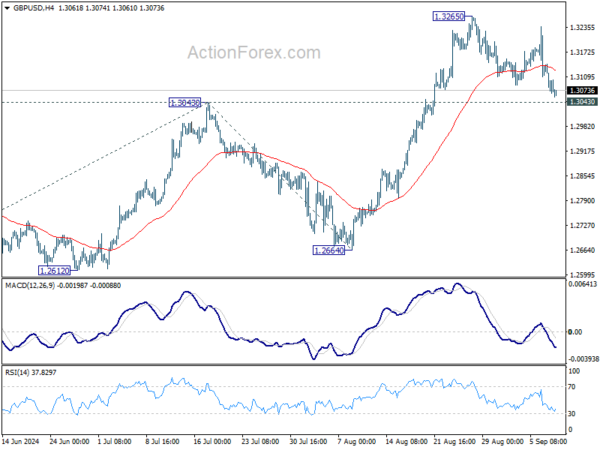

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3046; (P) 1.3095; (R1) 1.3121; More…

Intraday bias in GBP/USD remains neutral and outlook is unchanged. Further rise is expected with 1.3043 resistance turned support intact. On the upside, firm break of 1.3265 will resume larger up trend to 100% projection of 1.2298 to 1.3043 from 1.2664 at 1.3409. However, firm break of 1.3043 will turn bias back to the downside for deeper pullback.

In the bigger picture, up trend from 1.0351 (2022 low) is in progress. Next target is 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364. For now, outlook will stay bullish as long as 1.2664 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q2 | 0.10% | 0.70% | 0.80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Aug | 1.30% | 1.50% | 1.40% | |

| 00:30 | AUD | Westpac Consumer Confidence Sep | -0.50% | 2.80% | ||

| 01:30 | AUD | NAB Business Conditions Aug | 3 | 6 | ||

| 01:30 | AUD | NAB Business Confidence Aug | -4 | 1 | ||

| 03:00 | CNY | Trade Balance (USD) Aug | 91.0B | 82.1B | 84.7B | |

| 06:00 | GBP | Claimant Count Change Aug | 95.5K | 135K | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Jul | 4.10% | 4.20% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Jul | 4.10% | 4.50% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jul | 5.10% | 5.40% | ||

| 06:00 | EUR | Germany CPI M/M Aug F | -0.10% | -0.10% | ||

| 06:00 | EUR | GermanyCPI Y/Y Aug F | 1.90% | 1.90% | ||

| 08:00 | EUR | Italy Industrial Output M/M Jul | -0.10% | 0.50% | ||

| 10:00 | USD | NFIB Business Optimism Index Aug | 93.6 | 93.7 |