Asian Stocks Hit Records as Takaichi Win and Trade Deals Boost Confidence – Action Forex

Risk appetite swept across Asian markets today, lifting equities to fresh records as political clarity in Japan and trade optimism across the region buoyed investor confidence. Nikkei 225 surged to another all-time high after the Liberal Democratic Party’s Sanae Takaichi won 237 of 465 votes in the lower house, securing her position as Japan’s next prime minister. Her victory — comfortably exceeding the 233 needed for a majority — will see her confirmed by the upper house later today and sworn in as Japan’s 104th leader, marking a historic milestone as the nation’s first female premier.

Markets welcomed the outcome as a stabilizing force after weeks of political speculation. Investors see Takaichi as pro-stimulus and business-friendly, supportive of both monetary easing and fiscal investment. That policy outlook, combined with a weaker Yen, drove renewed buying across sectors.

In South Korea, KOSPI also hit its sixth straight record high, propelled by mounting optimism over an impending U.S.–Korea trade agreement. Stocks extended last week’s rally after U.S. Treasury Secretary Scott Bessent said negotiations were “about to finish up.” A finalized deal could ease tariff burdens and boost industrial exports, further cementing Korea’s trade position amid a recovering global supply chain.

Australia joined the regional rally, with ASX posting another intraday record. Shares in major critical minerals and rare earth companies surged following Monday’s announcement of an USD 8.5B minerals deal between Washington and Canberra. The agreement, signed by U.S. President Donald Trump and Prime Minister Anthony Albanese, will channel funding into multiple projects aimed at strengthening defense manufacturing and energy security — key areas of long-term strategic alignment between the two allies.

The flurry of positive regional developments reinforced a broader sense of stability after months of volatility driven by global trade and policy uncertainty. Asian equities benefited from a synchronized wave of optimism that extended from Tokyo to Sydney, with traders rotating back into cyclical and export-linked sectors.

In the currency markets, moves were more contained. Yen is currently the weakest performer this week, while Sterling and Loonie follow, while Aussie outperforms, as Swiss Franc and Kiwi also are firm. Dollar and Euro trade mid-pack. Most major currency pairs and crosses are still locked within last week’s ranges, awaiting fresh catalysts for breakout. However, based on current momentum, there is potential for Dollar to climb up the ladder in the coming sessions.

In Asia, at the time of writing, Nikkei is up 0.67%. Hong Kong HSI is up 1.61%. China Shanghai SSE is up 1.25%. Singapore Strait Times is up 1.31%. Japan 10-year JGB yield is down -0.011 at 1.658. Overnight, DOW rose 1.12%. S&P 500 rose 1.07%. NASDAQ rose 1.37%. 10-year yield fell -0.021 to 3.896.

New Zealand trade deficit widens NZD -14B despite strong 19% export growth

New Zealand recorded another sizeable trade deficit in September 2025, as import growth outstripped exports despite solid overseas demand. Statistics NZ data showed goods exports rose 19% yoy to NZD 5.8B. Imports increased 1.6% yoy to NZD 7.2B. The result was a monthly deficit of NZD -1.4B, versus expectation of NZD -6B and prior month’s NZD -1.2B.

Export strength was broad-based, led by double-digit gains to all major partners. Shipments to China jumped 24% yoy, Australia 28%, and Japan 23%, while sales to the U.S. and EU rose 10% and 15%, respectively.

On the import side, purchases from China climbed 16% yoy, while inflows from the EU and Australia rose 7.3% and 6.4%. Offsetting that, imports from the U.S. slumped -30%, and South Korea fell -4.8%.

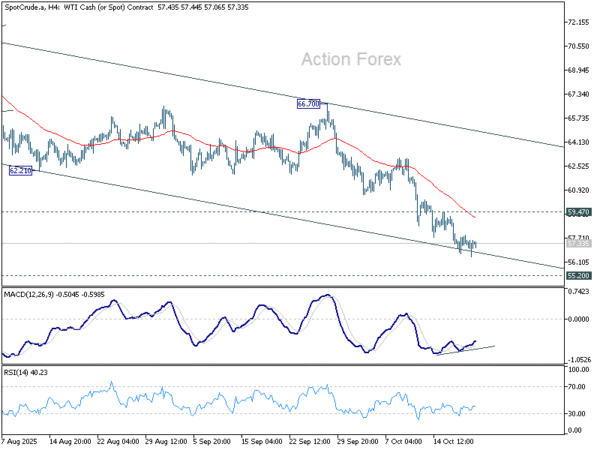

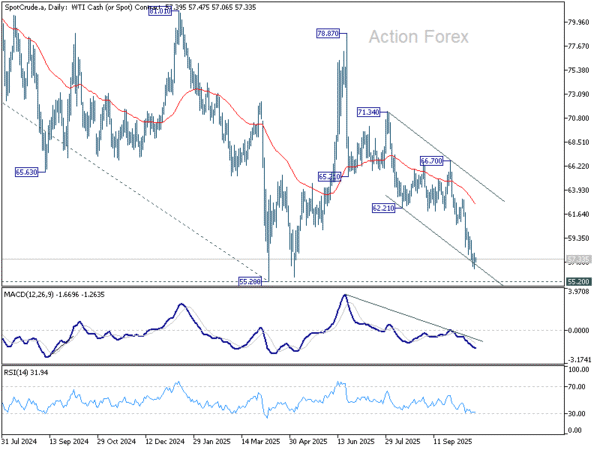

WTI oil to find floor near 55 as oversupply mostly priced in

Oil prices continued to drift lower this week but signs are emerging that the pace of decline is easing. With much of the supply glut now likely reflected in prices, there is potential for WTI crude to stabilize around 55 handle, even if near-term weakness extends.

The downtrend persisted since OPEC and its allies started expanding production earlier in the year, and major institutions warn that oversupply may persist well into next year. Last week’s IEA forecast reinforced bearish sentiment, warning that the global oil market could swing into a 4 million barrel-per-day surplus by in. The agency cited sustained output growth and sluggish demand as key drivers.

At the same time, geopolitical backdrop has also turned calmer. Ceasefire between Israel and Hamas helped reduce the Middle East risk premium, dampening prices further as fears of supply disruption fade.

Technically, however, downside momentum in WTI is fading. Bullish convergence is starting to appear in 4H MACD, while WTI is pressing the lower boundary of its near-term descending channel. The 55.20 key support, marking this year’s low from April, may offer strong support and turn WTI into sideway consolidations. Nevertheless, break of 59.47 resistance is needed to indicate short term bottoming, or risk will remain on the downside.

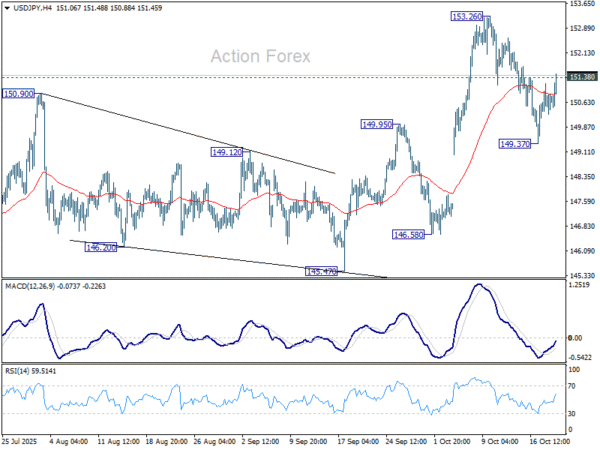

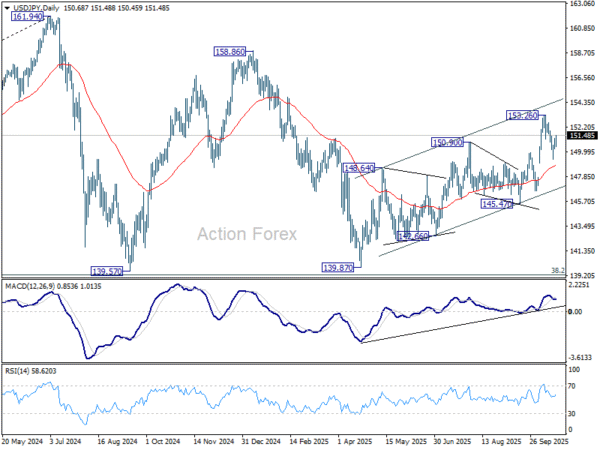

USD/JPY Daily Outlook

Daily Pivots: (S1) 150.29; (P) 150.75; (R1) 151.21; More…

USD/JPY’s break of 151.38 minor resistance suggests that corrective pullback form 153.26 has completed at 149.37 already. Intraday bias is back on the upside for retesting 153.26 resistance first. Firm break there will resume whole rise from 139.8y towards 158.86 resistance. On the downside, however, below 149.37 will target 55 D EMA (now at 148.78) instead.

In the bigger picture, current development suggests that corrective pattern from 161.94 (2024 high) has completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94 high. On the downside, break of 145.47 support will dampen this bullish view and extend the corrective pattern with another falling leg.